ALL RESOURCES

FILTER BY TAG

Select a tag

- Academic performance

- Accessibility

- Accountability

- Advocacy

- Advocates

- Article

- Bill analysis

- Bill tracker

- Billionaires

- Blog post

- Civil rights

- Coalition building

- Community Schools

- Cost impact analysis

- Dark Money

- Data

- Disability

- Discrimination

- Drain funds from public education

- Education Savings Account (ESA)

- English language learners

- Fact sheet

- Fraud Waste and Abuse

- Graphic

- History

- Indigenous and Native Education

- Integration

- LGBTQ+

- Legislation

- Letter

- Litigation

- Messaging or talking points

- Model legislation

- National Voucher

- News

- Parents

- Personal narrative

- Podcast

- Policy brief

- Policymakers

- Radio

- Referendum

- Religion

- Report

- Rural communities

- Segregation

- Separation of church and state

- Slide deck

- Slides

- State Constitutional Right to Education

FILTER BY AUTHOR

Select an author

- Aaron Sanderford

- Alec MacGillis

- Allen Pratt

- Associated Press

- Bob Peterson

- Bruce Schreiner

- Catherine Caruso

- David Montgomery

- David Pepper

- Eli Hager

- Emily Walkenhorst

- Ethan Dewitt

- Geoff Mulvihill

- Hilary Wething

- Howard Fischer

- Jason Bailey

- Jessica Corbett

- Jim Collier

- Joe Dana

- Joshua Cowen

- Juan Perez Jr.

- Kiera Butler

- Laura Pappano

- Liam Amick

- Maurice Cunnningham

- Nora De La Cour

- Paige Masten

- Patrick Darrington

- Paul Hammel

- Phil Williams

- Rob Boston

- Robert Huber

- Rowan Moore Geretsy

- Sasha Pudelski

Federal Voucher Program – FAQs

The expansion of private school vouchers through the inclusion of a federal voucher scheme in the budget reconciliation bill passed in July is part of a broader assault on public education designed to privatize one of the most important common goods underpinning American democracy. Opting in to the federal program (the state’s choice), even to use voucher money for public education students, broadly endangers public education and opens the door to further voucher expansion, whether vouchers are already available in a given state or not.

Big Ugly Bill Implications for Our Public Schools

These slides summarize the impact of the national voucher program and cuts to SNAP/Medicaid in the Trump administration's budget reconciliation bill.

States Must Reject Harmful Voucher Program

The federal voucher program contained in the budget reconciliation bill passed in early July will divert federal tax dollars from the U.S. Treasury and from services, including public education, that Americans rely on, to give to private and religious schools that pick and choose whom they educate and openly discriminate against some students and families.

Scamming Our Schools: Robbing Our Students’ Futures to Line Their Pockets

Senator Mazie K. Hirono (D-HI) led a spotlight forum focused on the harmful consequences the Republicans’ “Big Beautiful Bill” will have on students, parents, teachers, and schools across the country. Specifically, the forum highlights the school voucher-related provisions from the bill, which would divert billions of dollars in taxpayer funding to create the first ever national school voucher program.

The Fiscal Impacts of Expanded Voucher Programs and Charter-School Growth on Public Schools: Recommendations for Sustaining Adequate and Equitable School Finance Systems

The U.S. Department of Education has projected enrollment declines over the next decade, leading to budget cuts for school districts, which will be particularly impactful in urban and rural areas serving vulnerable students. As federal COVID-19 funds expire, districts will face challenges in cutting costs, potentially leading to layoffs or school closures. Meanwhile, many states have expanded voucher programs and charter schools, diverting funds from public schools despite limited enrollment growth. Research shows these shifts harm traditional public school financing. To address this, policymakers must ensure equitable funding for public schools and hold charter and private schools to the same standards as public ones.

Court Strikes Down South Carolina School Voucher Program

In many states, the challenge of creating a school voucher program is a constitutional requirement that public tax dollar are designated only for public schools. South Carolina’s legislature thought they had found a workaround; today the State Supreme Court said no.

What Is In The Federal School Voucher Bill

The Educational Choice for Children Act of 2024, introduced by Representative Adrian Smith (R-NE-3), would create school vouchers on the federal level, and as with all voucher programs, the devil is in the details. What do we find when we take a look under the hood?

Just How Bad Is the ‘Educational Choice’ Bill in Congress that Trump Is Expected to Support?

If passed, the ECCA will fund vouchers through a tax credit system. Contributors (which the bill refers to as “any taxpayer”) will donate money to a 501(3)(c) scholarship granting organization (SGO), which in turn awards the money as vouchers to families. The families may then use the money for a variety of education-related expenses, including private school tuition. Contributors then receive a dollar-for-dollar credit on their federal tax bill of up to $5,000 or 10 percent of their gross income—whichever is greater.

No Vouchers! Public Funds Are For Public Schools!

Experts including Professor Josh Cowen, ELC Senior Fellow and author of The Privateers: How Billionaires Created a Culture War and Sold School Vouchers, and Jessica Levin, ELC Litigation Director and Director of Public Funds Public Schools, discuss the implications of Donald Trump's presidency on public schools and voucher programs.

The Impact of Diverting Public Money to Private School Vouchers in Kentucky

The Kentucky General Assembly enacted a private school voucher program in 2021 and legislation was filed to expand the program before the state Supreme Court struck it down for violating Kentucky’s constitution. That decision led directly to the legislature putting Amendment 2 on the ballot. Similar states that lack Kentucky’s constitutional protections for public education have recently increased spending on vouchers and school privatization at a rapidly growing cost to their budgets. Given that history and context, it is plausible to assume the legislature will pursue a similar path if voters approve the amendment.

PA: Bill Proposes $8000 Payoff To Ditch Public School

A new bill in the Pennsylvania Senate is a sort of super-voucher stripped of any pretense, because it simply pays parents to pull their child out of public school.

Be wary of what you read in the school voucher debate

The information surrounding universal voucher programs is rife with advocacy masquerading as research.

Tax Avoidance Continues to Fuel School Privatization Efforts

One of the most disturbing recent shifts in U.S. public policy has been the renewed push to privatize the nation’s K-12 education system.[1] Originally born out of a desire to preserve school segregation and racial inequality more broadly, the so-called “school choice” movement is enjoying a resurgence as many state lawmakers look for ways to move more kids into private and religious schools.[2] That end is being hastened through the tax code in major ways. In short, school privatization proponents have managed to set up state policies that harness deficiencies in federal tax law and the self-interest of wealthy families to gin up enthusiasm for privatizing the U.S. public education system.

Toolkit: School Privatization Explained

The Network for Public Education Toolkit: School Privatization Explained was first created in 2017 to alert the general public regarding the various forms that privatization takes and the consequences associated with each. We’ve updated the toolkit to ensure the information is up-to-date. This toolkit presents evidence of what we already know about charters, vouchers and other forms of privatization. It is organized around key questions, providing answers in clear language to the questions we at NPE are most often asked.

Opposing Private School Vouchers:A Toolkit for Legislators and Advocates

This toolkit is designed as a resource to help legislators and pro-public education advocates oppose attempts to create new or expand existing private school voucher programs.

In recent years, a network of anti-public-education politicians and lobbying groups has been emboldened in its push for private school vouchers. Billionaires like the DeVoses, including former Education Secretary Betsy DeVos, the Kochs, and the Waltons are spending hundreds of millions of dollars on these campaigns. These funders are using their war chests to lobby for voucher bills in state legislatures, contribute to the political campaigns of pro-voucher candidates, and seed astroturf petition drives to put vouchers on the ballot.

Vouchers Forum 4.25.23

Illinois Families for Public Schools, the Illinois Education Association, the Illinois Federation of Teachers and the League of Women Voters of Illinois held a virtual forum on Tuesday April 25, 2023, "What You Need to Know about Invest in Kids: Illinois’ Tax Credit Voucher Program."

Who Supports Illinois’ Invest In Kids Voucher Program?

Voucher programs around the country—whether in the form of traditional vouchers, education savings accounts (ESAs),or tax credit scholarships—are supported by well funded and organized groups. These include: Americans for Prosperity (the Koch brothers’ 501c4), the American Legislative Education Council (ALEC), the American Federation for Children (Betsy DeVos’ 501c4), Moms for Liberty and the Heritage Foundation, among others.

What do these organizations have in common? They work openly to discredit public schools and push a privatization agenda, using the slogans of school choice, education freedom and parent rights. Many of them were on the ground working on the April 2023 school board elections in Illinois.

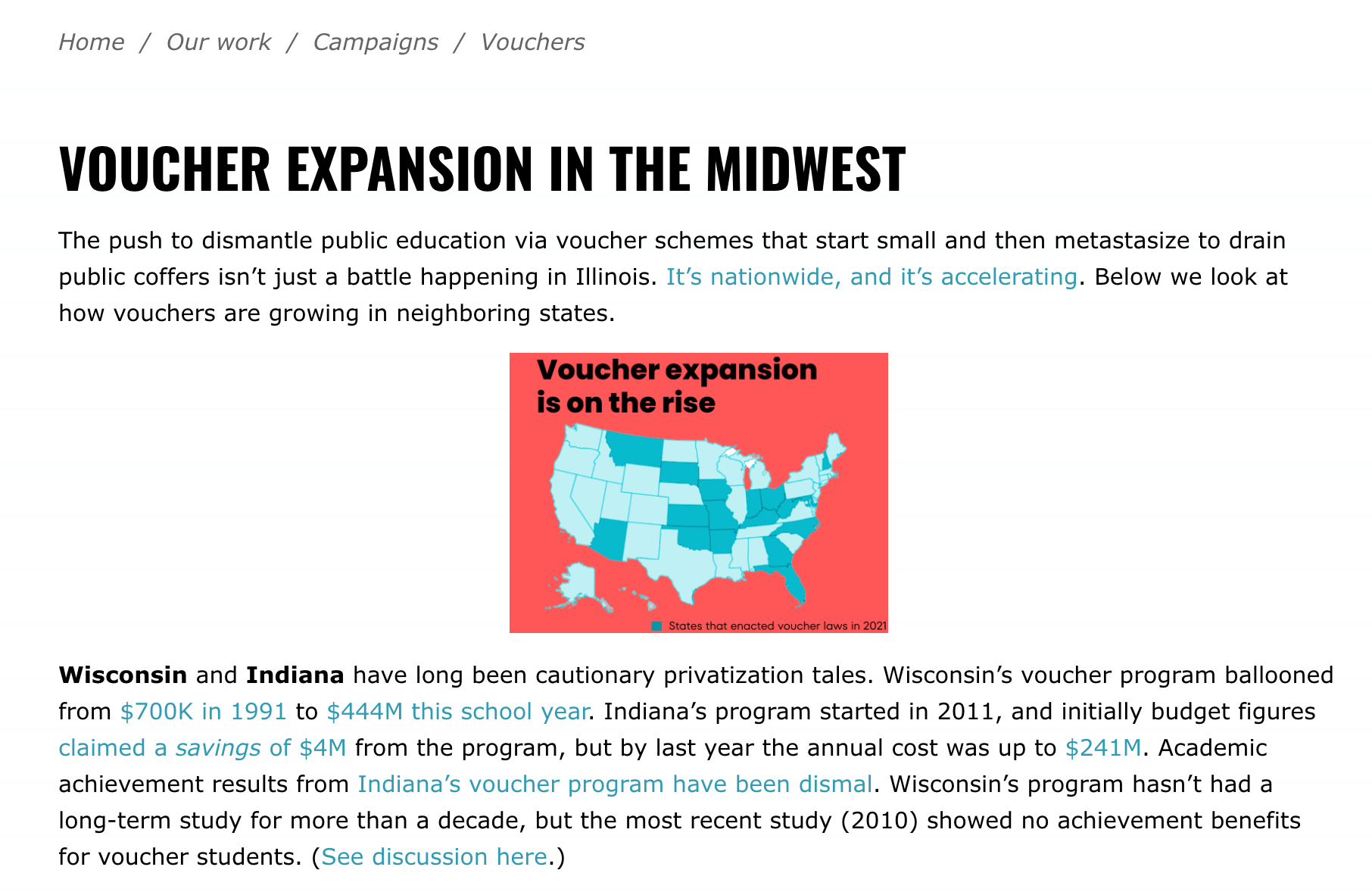

Voucher Expansion in the Midwest

The push to dismantle public education via voucher schemes that start small and then metastasize to drain public coffers isn’t just a battle happening in Illinois. It’s nationwide, and it’s accelerating.

Voucher Web page

This web page from Illinois Families for Public Schools includes blog posts covering school voucher programs in Illinois.

Game Over for School Vouchers in Illinois!

In 2017, as a result of a backroom deal between then Governor Rauner, legislative leaders and the Archbishop of the Archdiocese of Chicago, the IL General Assembly created a K-12 voucher program for Illinois in the form of a tax credit scholarship scheme. Known as the Invest in Kids Act, the law allows up to $75 million in tax revenue to be diverted to private schools each year. More than $250 million state dollars have now been siphoned off to private schools in our state.

This program was intended to last for five years and to sunset after the 2022-2023 school year. It was extended for one additional school year already. Voucher supporters and school privatizers want it to be made permanent and expand!