ALL RESOURCES

FILTER BY TAG

Select a tag

- Academic performance

- Accessibility

- Accountability

- Advocacy

- Advocates

- Article

- Bill analysis

- Bill tracker

- Billionaires

- Blog post

- Civil rights

- Coalition building

- Community Schools

- Cost impact analysis

- Dark Money

- Data

- Disability

- Discrimination

- Drain funds from public education

- Education Savings Account (ESA)

- English language learners

- Fact sheet

- Fraud Waste and Abuse

- Graphic

- History

- Indigenous and Native Education

- Integration

- LGBTQ+

- Legislation

- Letter

- Litigation

- Messaging or talking points

- Model legislation

- National Voucher

- News

- Parents

- Personal narrative

- Podcast

- Policy brief

- Policymakers

- Radio

- Referendum

- Religion

- Report

- Rural communities

- Segregation

- Separation of church and state

- Slide deck

- Slides

- State Constitutional Right to Education

FILTER BY AUTHOR

Select an author

- Aaron Sanderford

- Alec MacGillis

- Allen Pratt

- Associated Press

- Bob Peterson

- Bruce Schreiner

- Catherine Caruso

- David Montgomery

- David Pepper

- Eli Hager

- Emily Walkenhorst

- Ethan Dewitt

- Geoff Mulvihill

- Hilary Wething

- Howard Fischer

- Jason Bailey

- Jessica Corbett

- Jim Collier

- Joe Dana

- Joshua Cowen

- Juan Perez Jr.

- Kiera Butler

- Laura Pappano

- Liam Amick

- Maurice Cunnningham

- Nora De La Cour

- Paige Masten

- Patrick Darrington

- Paul Hammel

- Phil Williams

- Rob Boston

- Robert Huber

- Rowan Moore Geretsy

- Sasha Pudelski

The Impact of Diverting Public Money to Private School Vouchers in Kentucky

The Kentucky General Assembly enacted a private school voucher program in 2021 and legislation was filed to expand the program before the state Supreme Court struck it down for violating Kentucky’s constitution. That decision led directly to the legislature putting Amendment 2 on the ballot. Similar states that lack Kentucky’s constitutional protections for public education have recently increased spending on vouchers and school privatization at a rapidly growing cost to their budgets. Given that history and context, it is plausible to assume the legislature will pursue a similar path if voters approve the amendment.

How Voucher Programs Undermine the Education Landscape in North Carolina

In 2023, North Carolina lawmakers went all-in on vouchers. Via changes incorporated in the 2023 budget bill, North Carolina became the tenth state with a universal voucher program, one in which all private school students are eligible for state-funded subsidies regardless of their family income.

The Impacts of Universal ESA Vouchers: Arizona’s Cautionary Tale

Last year, Arizona lawmakers enacted universal Empowerment Scholarship Account (ESA) vouchers by a razor-thin margin, after voters overwhelmingly rejected the plan in 2018. On September 30, 2022, all students in Arizona became eligible for private school vouchers. One year into this failed experiment, the out-of-control growth of Arizona's ESA voucher program spells economic crisis for the state, as well as the public schools that 92% of Arizona families choose.

The Dangers of Private School Vouchers for Idaho Students, Schools, and Communities

This report by Public Funds Public Schools (PFPS) and the Idaho Center for Fiscal Policy (the Center) explains why Idaho policymakers must continue to reject proposals for private school vouchers and instead invest in the state’s underfunded public education system, which serves the vast majority of children.

Florida’s Hidden Voucher Expansion

Florida receives an F on an A-F scale on all three funding metrics: funding level, funding distribution, and funding effort.

Since 2019, the flow of public funds to private education dramatically increased after the State Legislature enacted the Family Empowerment Scholarship (FES) program.

NEPC Review: The Ohio EdChoice Program’s Impact on School District Enrollments, Finances, and Academics

A recent report from the Thomas Fordham Institute, The Ohio EdChoice Program’s Impact on School District Enrollments, Finances, and Academics, considers three possible harms associated with Ohio’s voucher program: to public school student outcomes through com- petition, to district financial resources, and increased racial segregation. Finding that Ohio vouchers have had few such harmful impacts, the report concludes that it has effectively dismissed the primary concerns of voucher critics. Yet, while the report is broadly methodologically sound for the narrow questions it poses, the questions it asks are out-of-date with respect to current concerns raised by voucher critics, which focus on substantially decreased student achievement among students using vouchers.

State of Ohio Schools 2023

Ohio's students deserve a world-class education, including safe and well-resourced schools that are staffed with teachers who are well trained and fairly paid. Providing that education is our shared responsibility, and we all share its benefits as well: Every family does better when the next generation is prepared for the future, every community is enhanced when its young people are engaged, curious and active participants, and every boss wants a highly qualified hiring pool.

However, the combined effects of the COVID pandemic and Ohio’s legacy of inadequate, inequitable funding have weakened the role school plays as a foundational public institution. Ohio ranks 21st in the nation for K-12 education, 46th for equitable distribution of funding, and 40th in starting teacher salaries. Ohio public schools educate 1.7 million students across racial, gender, socioeconomic and geographic lines — and every one of them deserves better.

Funding Ohio’s Future

School is a place where childhood happens. Ohio’s public educators teach children of all races and backgrounds basic skills, but also challenge and inspire them to follow their dreams. For many students, school is a safe place to learn, develop and grow.

Ohio currently educates 1.6 million children attending school in our cities, suburbs and small towns. For years, almost no one was happy about how the state of Ohio funded public schools. The system pitted communities against each other and private and charter schools against public schools. We were living in the K-12 version of the “Hunger Games”: The wealthier your district, the stronger your chances of success.

Studies and Reports

The National Coalition for Public Education has compiled studies and reports on school voucher programs.

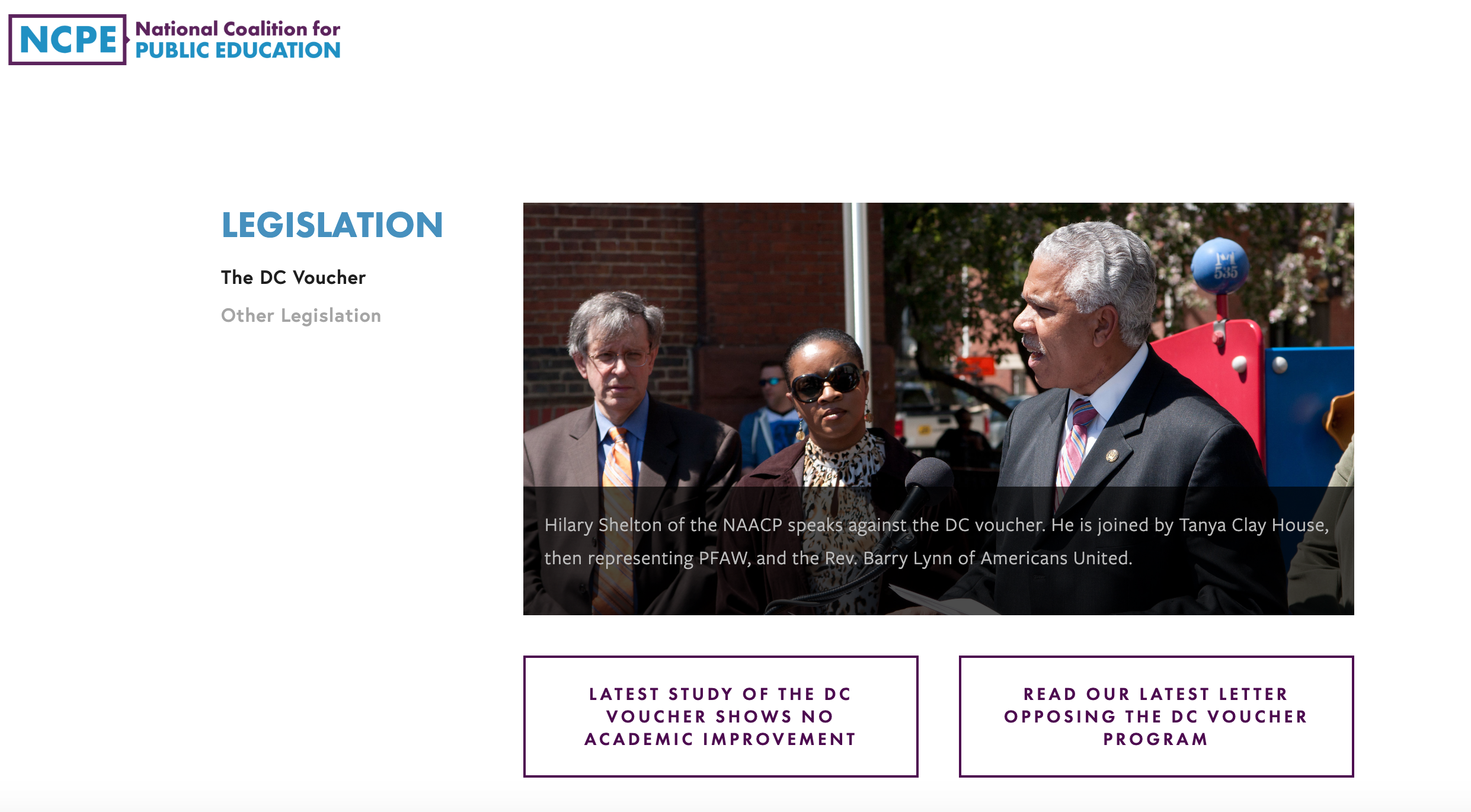

The DC Voucher

The National Coalition for Public Education has developed an in-depth summary of the DC Voucher program which tracks legislation and includes summaries and links to sources.

The Fiscal Consequences of Private School Vouchers

The use of publicly funded vouchers to support enrollment in private schools has a long history, but only over the past dozen years have private school vouchers gained significant traction in the United States. In some states over this time period, the growth in voucher programs has been dramatic.

Impact Report 2021 – 22

The 2022-23 PPS Impact Report celebrates PPS’s continued commitment to advancing the role of families and communities in securing a high-quality public education for every child. The report also includes PPS’s statement in opposition to vouchers and work with other statewide advocacy groups against vouchers.

Inequity in School Funding

This report from the Education Law Center and the Southern Poverty Law Center illustrates that while southern states are failing to adequately fund their public schools, almost all of them are funneling scarce education funding to private schools through voucher programs and otherwise engaging in “culture wars” that seek to undermine public education.

NEPC Review: Qualified Education Expense Tax Credit: Economic Analysis (Georgia Department of Audits and Accounts, June 2023)

A recent report from the Georgia Department of Audits and Accounts examines the monetary costs and benefits of the state’s Qualified Education Expense Tax Credit (QEEC). The QEEC is a type of voucher policy that provides a public subsidy for families to pay for private school tuition. Data show the tax credit results in $81 million of forgone state tax revenue per year. The report argues the QEEC provides a net fiscal benefit for Georgia’s state budget based on an estimate that the vouchers cause almost 20,000 students per year to choose private schools instead of public, thus removing the cost of educating those students from state and local budgets. However, because the report relies on unrealistic assumptions, its suggestion that program benefits outweigh costs is tenuous and risks misleading state education leaders. Instead, state leaders should invest educational dollars in policies that have a positive return on in- vestment and therefore help, rather than harm, state and local budgets.

PEER Review of Vouchers: Fraud, Lack of Accountability; Unspent Funds

Mississippi’s PEER* Committee issues a report of the state’s ESA voucher program, which uses public funds to pay private school tuition for children with special needs.

Accountability and Private School Choice

The report Accountability and Private-School Choice, released by the Manhattan Institute in October, 2021, addresses the question of how private school voucher programs should be regulated. That is, if private schools are to receive public funds, what accountability mech- anisms can fairly and reasonably safeguard taxpayer dollars? The report advocates for re- laxing accountability mechanisms that presently constrain some voucher programs, assert- ing that “more and better” private schools will participate in response, benefitting students academically. Such claims, however, are supported by a selective reading and intentional misreading of educational research. Insofar as that is the case, the report merely repeats well-worn ideological positions and neither advances what we know about the challenge of regulating private schools nor offers useful information for policy decisions.

Public Dollars for Private Schools: 6 Recommendations for North Carolina’s School Voucher Program

In this policy brief the Public School Forum of North Carolina provides six recommendations for North Carolina’s Opportunity Scholarship school voucher program. The Opportunity Scholarships program in its current or expanded form represents significant investment of taxpayer dollars to support private and parochial schools. Similar to public schools and public charter schools, private schools that receive public dollars must be held accountable to the taxpayers who fund them. Additionally, parents must have access to accurate and reliable information when making school choice decisions, and state leaders must have the data needed to effectively evaluate how private schools receiving public funds are performing and to ensure that all children are receiving a sound basic education.

Report to the Shapiro/Davis Team on Education in the Commonwealth

Education Voters of Pennsylvania developed this section on Pennsylvania’s EITC/OSTC school voucher programs with support from the PA Schools Work Campaign. The Educational Improvement Tax Credit (EITC) and Opportunity Scholarship Tax Credit (OSTC) voucher programs work by reducing taxes paid by businesses to the state when they contribute to scholarship organizations that provide vouchers for children to attend a private or religious school. The programs are administered by the Pennsylvania Department of Community and Economic Development (DCED).

FAQs About Pennsylvania’s EITC and Vouchers for Private and Religious Schools

Pennsylvania has two programs that give tax money to private schools: the Educational Improvement Tax Credit (EITC) and the Opportunity Scholarship Tax Credit (OSTC) programs. Each year, EITC and OSTC provide $230 million to private scholarship organizations, or “SOs,” which award tuition vouchers to families whose children attend private and religious schools. Because the Pennsylvania Constitution prohibits using tax dollars for religious education, the EITC and OSTC programs are workarounds designed to evade this prohibition. Instead of paying their taxes to the Commonwealth, companies direct their tax payments to an EITC or OSTC “scholarship” organization.

Pennsylvania Voucher Schools Use Tax Dollars to Advance Discrimination

Education Voters of Pennsylvania developed this report on the $340 million in annual funding for EITC and OSTC programs that provide taxpayer-supported vouchers to students who attend private and religious schools.