ALL RESOURCES

FILTER BY TAG

Select a tag

- Academic performance

- Accessibility

- Accountability

- Advocacy

- Advocates

- Article

- Bill analysis

- Bill tracker

- Billionaires

- Blog post

- Civil rights

- Coalition building

- Community Schools

- Cost impact analysis

- Dark Money

- Data

- Disability

- Discrimination

- Drain funds from public education

- Education Savings Account (ESA)

- English language learners

- Fact sheet

- Fraud Waste and Abuse

- Graphic

- History

- Indigenous and Native Education

- Integration

- LGBTQ+

- Legislation

- Letter

- Litigation

- Messaging or talking points

- Model legislation

- National Voucher

- News

- Parents

- Personal narrative

- Podcast

- Policy brief

- Policymakers

- Radio

- Referendum

- Religion

- Report

- Rural communities

- Segregation

- Separation of church and state

- Slide deck

- Slides

- State Constitutional Right to Education

FILTER BY AUTHOR

Select an author

- Aaron Sanderford

- Alec MacGillis

- Allen Pratt

- Associated Press

- Bob Peterson

- Bruce Schreiner

- Catherine Caruso

- David Montgomery

- David Pepper

- Eli Hager

- Emily Walkenhorst

- Ethan Dewitt

- Geoff Mulvihill

- Hilary Wething

- Howard Fischer

- Jason Bailey

- Jessica Corbett

- Jim Collier

- Joe Dana

- Joshua Cowen

- Juan Perez Jr.

- Kiera Butler

- Laura Pappano

- Liam Amick

- Maurice Cunnningham

- Nora De La Cour

- Paige Masten

- Patrick Darrington

- Paul Hammel

- Phil Williams

- Rob Boston

- Robert Huber

- Rowan Moore Geretsy

- Sasha Pudelski

Latest News

The National Coalition for Public Education monthly compilation of news article on voucher programs.

What You Need to Know About the National Private School Voucher Proposal

School vouchers allow families to use public funds to pay for their children’s private school tuition. School voucher programs enacted across the country – using tax credits, grants, and savings accounts to divert public funding to pay for private education – have consistently demonstrated that states with voucher programs tend to expand the programs over time. These expansions dramatically increase the amount of public funds diverted to private education while state investments in public education remain stagnant or decrease. Despite the numerous negative consequences of using publicly funded vouchers to pay for K-12 private education expenses,1 policy makers across the country continue to propose similar programs.

Voucher Boondoggle: House Advances Plan to Give the Wealthy $1.20 for Every $1 They Steer to Private K-12 Schools

While there was never any question as to whether the committee’s majority supported private school vouchers, this is the first time they have gone on the record specifically endorsing the kind of profitable tax shelter embedded in many voucher programs. As we learned yesterday, most of the House Ways & Means Committee is content to facilitate new forms of wasteful tax avoidance if doing so aids the cause of funneling more public resources into private K-12 schools.

States Should Bolster, Not Undermine, Education Gains Made with ESSER Funds

Over half of states divert public dollars away from public schools to private schools through school vouchers. In 2024, 14 states enacted new, or expanded existing, school voucher programs, and Colorado and Kentucky are considering legalizing school vouchers through ballot measures. For example, Florida will spend almost $4 billion on its school voucher program this year, an amount that could easily replace Florida’s total annual ESSER loss if invested in public, rather than private, schools.

South Carolina Supreme Court Strikes Down Unconstitutional Private School Vouchers

In a major victory for public school students in South Carolina—and across the country—the South Carolina Supreme Court has struck down the private school voucher program enacted by the State Legislature in 2023.

PA: Bill Proposes $8000 Payoff To Ditch Public School

A new bill in the Pennsylvania Senate is a sort of super-voucher stripped of any pretense, because it simply pays parents to pull their child out of public school.

More Momwashing For Privatization

The parenting bubble for anti-public ed activism is really expanding.

Jeanne Allen's Center for Education Reform has just rolled out the Parent Power Index! It assigns arbitrary values measures three vaguely defined qualities-- choice programs, charter schools, and innovation-- and gives each state a letter grade. There's nothing new being quantified here, just the same old anti-public school, anti-union wine in new parentified wineskins

Be wary of what you read in the school voucher debate

The information surrounding universal voucher programs is rife with advocacy masquerading as research.

Jim Walton gives $500K to defend Arkansas school vouchers from ballot measure

Walmart heir and Arvest Bank CEO Jim Walton donated $500,000 last month to a group working to defeat a proposed constitutional amendment on K-12 education, according to documents filed this week with the Arkansas Ethics Commission.

How Do Vouchers Defund Public Schools? Four Warnings and One Big Takeaway

Over the past two years, school voucher systems and other related schemes that divert taxpayer revenue toward private K-12 tuition have passed state legislatures at unprecedented rates. Although these recent bills became law only, for the most part, in red states, their supporters include a handful of Democrats in other parts of the country as well. And all of this comes despite a decade of evidence that vouchers have led to some of the steepest declines in student achievement on record.

States Should Reverse Course on Defunding Public Education Through Private School Vouchers and Property Tax Cuts

During this year’s legislative sessions, at least one in three states are considering or have enacted school voucher expansions alongside broad, untargeted property tax cuts. Over half of states have already enacted deep personal and corporate income tax cuts in the last three years. These policies will result in under-resourced public schools, worse student outcomes, and, over time, weaker communities.

Vouchers undermine efforts to provide an excellent public education for all

Since the early 2000s, many states have introduced significant voucher programs to provide public financing for private school education. These voucher programs are deeply damaging to efforts to offer an excellent public education for all U.S. children—and this is in fact often the intention of those pushing these programs.

Private School Vouchers: Diversion of Public Funds Through Expanded 529 Plans

This is the fifth and final part in our series, Private School Vouchers: Analysis of 2020 Legislative Sessions. This annual PFPS analysis provides an overview of proposed voucher legislation nationwide and deeper dives on key states and issues. Read the first, second, third, and fourth parts.

Vouchers Forum 4.25.23

Illinois Families for Public Schools, the Illinois Education Association, the Illinois Federation of Teachers and the League of Women Voters of Illinois held a virtual forum on Tuesday April 25, 2023, "What You Need to Know about Invest in Kids: Illinois’ Tax Credit Voucher Program."

Vouchers Fund Discrimination

Public schools in Illinois can't discriminate on the basis of disability status, gender identity, sexual orientation, language, pregnancy or parenting status, marital status, or religion. But under the Invest in Kids voucher program, public dollars are now going to private schools in Illinois, many of which do discriminate against students in all these protected categories.

Who Supports Illinois’ Invest In Kids Voucher Program?

Voucher programs around the country—whether in the form of traditional vouchers, education savings accounts (ESAs),or tax credit scholarships—are supported by well funded and organized groups. These include: Americans for Prosperity (the Koch brothers’ 501c4), the American Legislative Education Council (ALEC), the American Federation for Children (Betsy DeVos’ 501c4), Moms for Liberty and the Heritage Foundation, among others.

What do these organizations have in common? They work openly to discredit public schools and push a privatization agenda, using the slogans of school choice, education freedom and parent rights. Many of them were on the ground working on the April 2023 school board elections in Illinois.

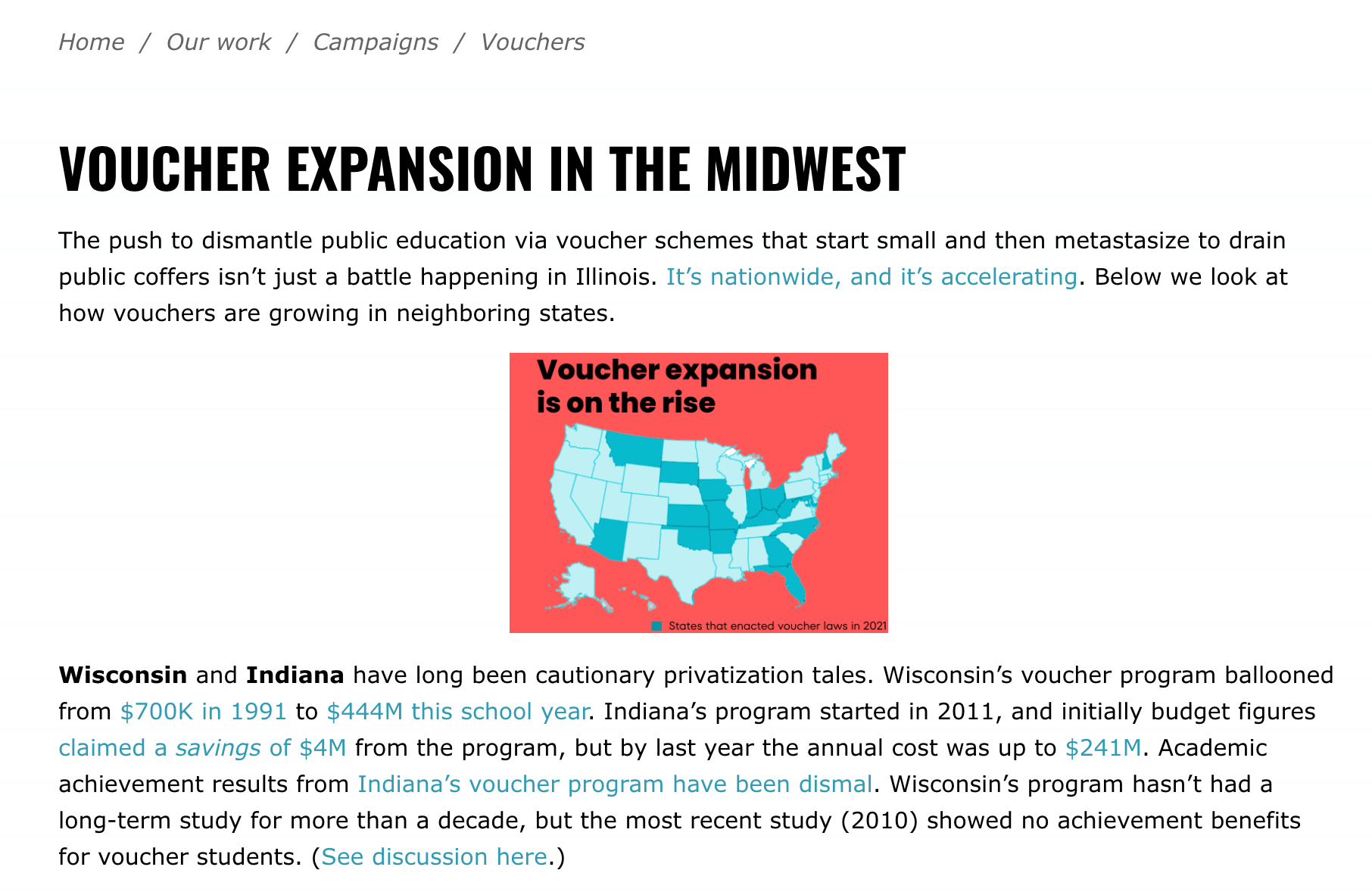

Voucher Expansion in the Midwest

The push to dismantle public education via voucher schemes that start small and then metastasize to drain public coffers isn’t just a battle happening in Illinois. It’s nationwide, and it’s accelerating.

Voucher Web page

This web page from Illinois Families for Public Schools includes blog posts covering school voucher programs in Illinois.

Game Over for School Vouchers in Illinois!

In 2017, as a result of a backroom deal between then Governor Rauner, legislative leaders and the Archbishop of the Archdiocese of Chicago, the IL General Assembly created a K-12 voucher program for Illinois in the form of a tax credit scholarship scheme. Known as the Invest in Kids Act, the law allows up to $75 million in tax revenue to be diverted to private schools each year. More than $250 million state dollars have now been siphoned off to private schools in our state.

This program was intended to last for five years and to sunset after the 2022-2023 school year. It was extended for one additional school year already. Voucher supporters and school privatizers want it to be made permanent and expand!

Ensuring Fair School Funding for All Students.

Policies that base funding on community wealth and ignore the real costs of educating all students hurt everyone, especially students of color, students from families with limited incomes, and students who require additional programs, supports and services.